If you have not formally created your legal entity check with your state to ensure that the name you are using is available and check to be sure that you are not infringing on any existing trademarks. Featured PwC Malaysia publications.

5 Reasons To Run Your Business Under A Sdn Bhd In Malaysia Foundingbird

This company manifesto undertakes any possible legal obligations and has a full capability to sue other entities if needed.

. This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials and help us understand your interests and. Therefore in the future the tax. Malaysia also has a reported critical occupations list COL highlighting job types where there is a skills shortage within the country that supports work permitsvisa applications.

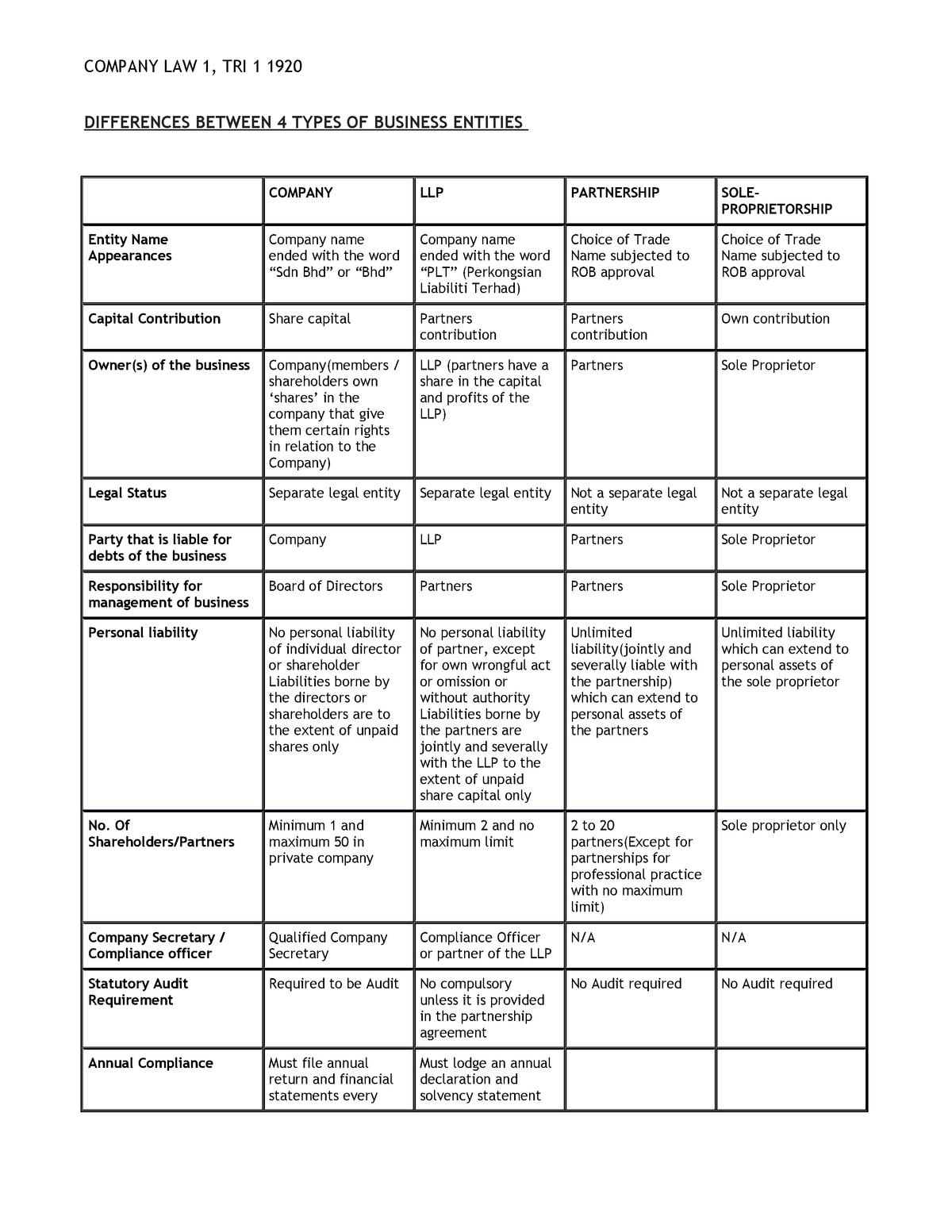

Sdn Bhd companies in Malaysia come with business continuity which means the business can carry on until such time when there is a valid reason as to why it needs to cease its business operations. It is a body corporate and is a separate legal entity from its partners. A promoter is someone.

Even before the proclamation of the formation of the Federation of Malaysia on 16 September 1963 leaders from both sides of the. The Sdn Bhd is a separate legal entity from its owners and can raise capital through shares. LLP is a separate legal entity just like Limited Liability Company LLC.

The separation was the result of deep political and economic differences between the ruling parties of Singapore and Malaysia. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions and not those of each other. Each type of pass has its.

DTTL does not provide services to clients. An Entity such as a partnership limited liability partnership or similar legal arrangement that has no residence for tax purposes shall be treated as resident in the jurisdiction in which its place of effective management is situated. Since an Sdn Bhd company is considered a separate legal entity the owners personal wealth is protected which is one of its major advantages.

LLCs and corporations are both legal entities that have an existence separate from their owners called shareholders in the case of a corporation and members in the case of an LLC. To set up a Sdn Bhd the company must have. DTTL does not provide services to clients.

At present most of the LEI requirements are derived from the Markets in Financial Instruments Directive MiFID II and. At the end of year 3 the entitys taxable temporary differences have decreased to 260 since the company has now been charged tax on the difference of 140 500 depreciation - 360 tax depreciation. Keep updated on key thought leadership at PwC.

You may also want to file with. The SPV is a separate legal entity from the existing legal status of the parties to the joint venture. A business entity is an entity that is formed and administered as per corporate law in order to engage in business activities charitable work or other activities allowable.

As such its legal status prevents adverse project or financial risks from being transferred to or from the parties to the joint venture. An employment pass a professional visit pass and a temporary employment pass. EY refers to the global organization and may refer to one or more of the member firms of Ernst Young Global Limited each of which is a separate legal entity.

DTTL also referred to as Deloitte Global and each of its member firms and related entities are legally separate and independent entities which cannot obligate or bind each other in respect of third parties. LLP being separate entity keeps partners safe from personal liabilities and bear all obligations and legal complains to itself. This entity is suitable for small companies or startups.

A Provide the complete legal name of the partnership entity. As of January 3rd 2018 all legal entities which wish to transact in European financial markets involving any kind of securities or derivates for example Stocks Bonds ETFs FX Forwards Swaps Interest rate Swaps etc need to register for an LEI number. Featured PwC Malaysia publications.

This form of protection limits the liability of the parties to the joint venture to their shareholding in. 2022 United Nations Ocean Conference Closing remarks. It should be the name you have registered with your appropriate state department.

Most often business entities are formed to sell a product or a service. As such if an Entity certifies that it has no residence for tax purposes it should complete the form stating the address of its principal office. This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials and help us understand your interests and.

On 9 August 1965 Singapore separated from Malaysia to become an independent and sovereign state. And all state corporation statutes and LLC statutes provide that corporations and LLCs are liable for their own debts and the shareholders and members are not personally liable based. There are many types of business entities defined in the legal systems of various countries.

At least 1 director ordinarily resident in Malaysia 1 shareholder. Keep updated on key thought leadership at PwC. Tax Leader PwC Malaysia 60 3 2173 1469.

You do not have to be physically present in Malaysia as long as the director and shareholder requirements are fulfilled. These include corporations cooperatives. DTTL also referred to as Deloitte Global and each of its member firms and related entities are legally separate and independent entities which cannot obligate or bind each other in respect of third parties.

Statement at the annual meeting with members of the International Law Commission. In other words they are now adding back more depreciation in their tax computation than they are able to deduct in tax depreciation. It also has less compliance requirements compared to other business entities and is more affordable.

In Malaysia there are three work permitvisa types. Funded by the Capital Markets Development Fund CMM showcases the competitiveness and attractiveness of the various segments of the Malaysian. Tax Leader PwC Malaysia 60 3 2173 1469.

Ernst Young Global Limited a UK company limited by guarantee does not provide services to clients. Legal Counsels speeches. A limited liability partnership provides asset protection to its partners if the company goes bankrupt or in debt.

DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions and not those of each other. About Capital Markets Malaysia CMM The Securities Commission Malaysia SC set up CMM in 2014 to spearhead the local and international positioning as well as profiling of the Malaysian capital market.

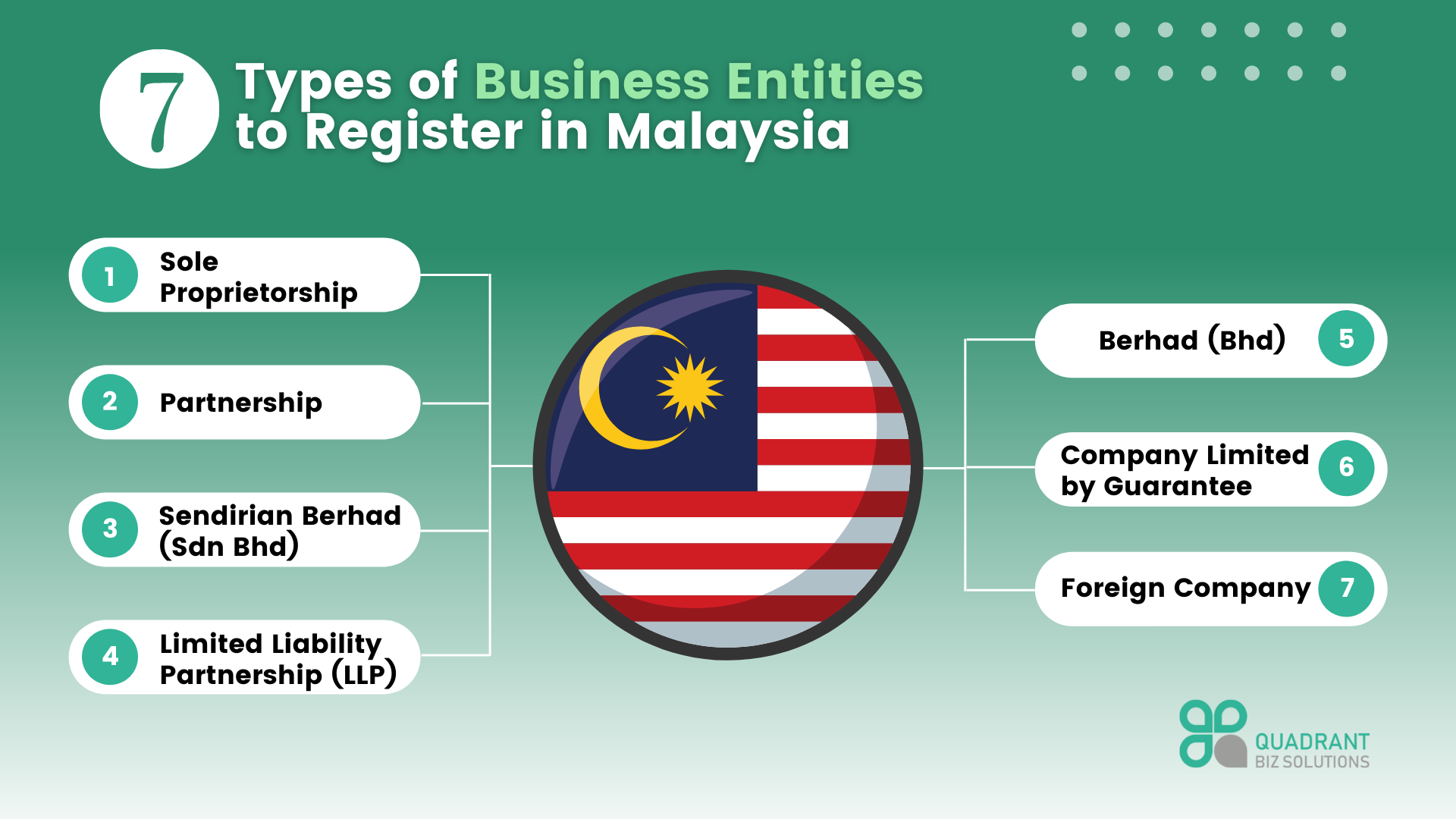

What Are The 5 Types Of Business Entity In Malaysia

8 Types Of Business Entities To Register In Malaysia Foundingbird

6 Types Of Business Entities In Malaysia Tetra Consultants

Separate Legal Existence The Most Important Feature Of A Company

Separate Legal Entity Ipleaders

St Partners Plt Chartered Accountants Malaysia Different Type Of Business Entities In Malaysia Part 2 Limited Liability Partnership In Malaysia The Type Of Business Available Are 1 Enterprise 2 Limited

Understanding Business Entities In Malaysia Quadrant Biz Solutions

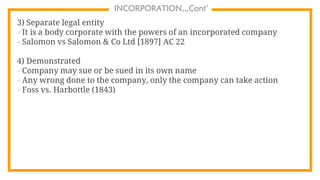

Incorporation And Its Effects Ppt Video Online Download

Piercing The Corporate Veil What Does This Mean For A Company Malaysian Litigator

Advantages Of Having Sdn Bhd Company In Malaysia Yh Tan Associates Plt

5 Different Types Of Business Entities In Malaysia

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Incorporation And Its Effects Ppt Video Online Download

Differences Between 4 Types Of Business Entities Company Law 1 Tri 1 1920 Differences Between 4 Studocu

Company Law Notes Introduction Company Is A Form Of Incorporated Business Organisation Which Is Studocu